News & Video

-

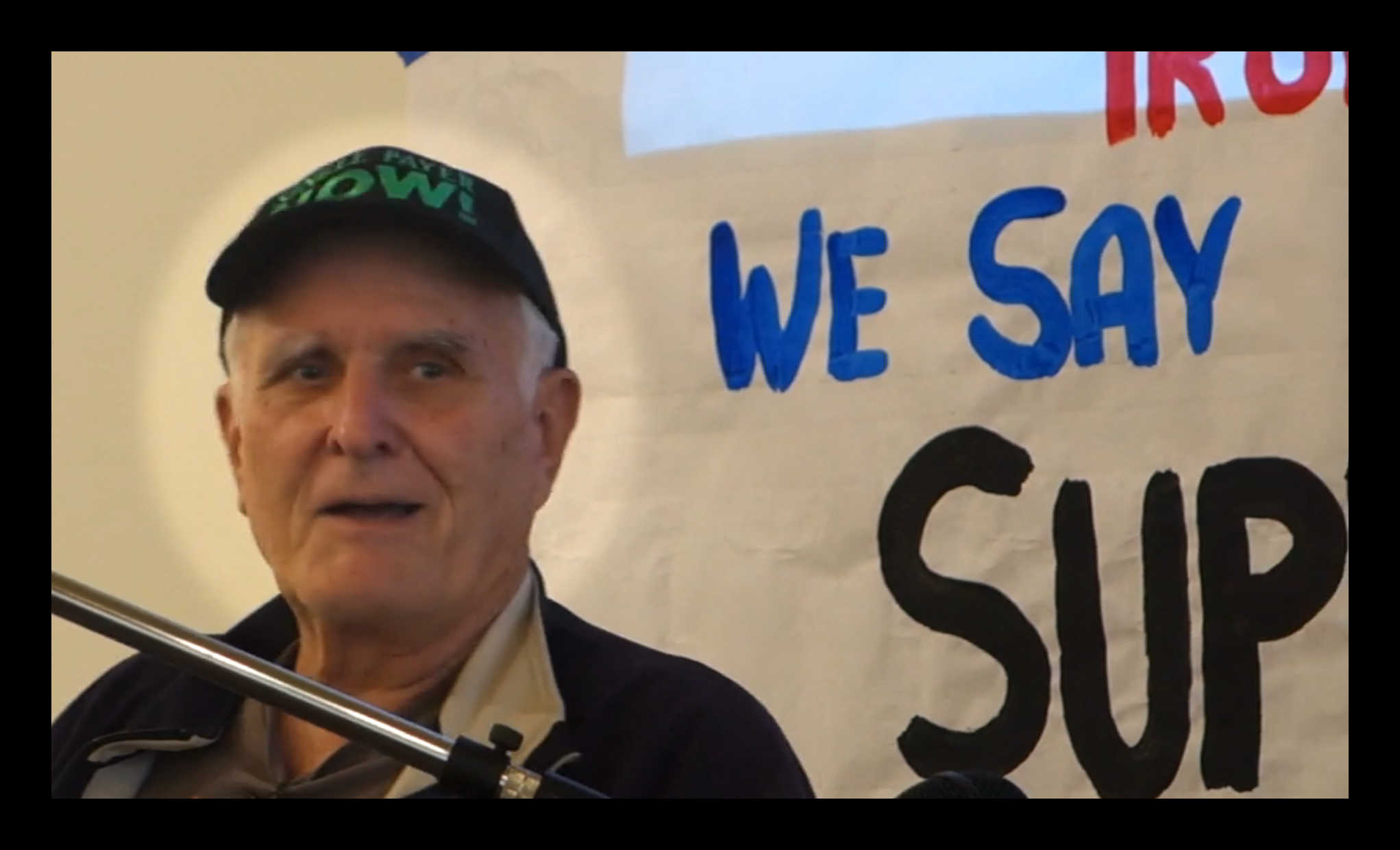

Don Bechler, 1947 – 2020

Don Bechler, the founder and director of Single Payer Now, passed away on October 24, 2020. After taking a break to grieve the loss of Don, we are now trying to revive SPN in his absence.

-

Medicare for All, or Medicare for More?

Even in this early stage of the 2020 race, nearly all of President Donald Trump’s would-be opponents have staked out their support for expanding health-care coverage.

-

The Health 202: Jayapal to roll out sweeping Medicare-for-All bill by month’s end

Jayapal said she’s confident she’ll have 100 co-sponsors by the time of the bill’s planned Feb. 26 release, explaining she’s not surprised members would take more time to consider it given its length.

-

Congresswoman Pramila Jayapal’s House Medicare for All Bill

Congresswoman Pramila Jayapal’s House Medicare for All Bill to be released 2/26/19

-

New York Getting Closer to Enacting State Single Payer System

Activists Rally: Demand Albany Pass NY Single-Payer Bill By Dave Lucas • 14 hours ago With the country once again debating the future of health care, activists rallied Tuesday in Albany in support of a bill that would create a universal, publicly-financed health-insurance plan for all New Yorkers. Rallygoer and Green Party candidate for Albany…

-

Sanders to offer single payer plan

Posted from Politico by: Christiano Lima Sen. Bernie Sanders said Sunday he planned to introduce a single-payer health care plan to Congress, inviting Republican leaders to negotiate the measure. “I’m going to introduce a Medicare-for-all single-payer program,” Sanders told anchor Dana Bash on CNN’s “State of the Union.” The Vermont senator, who has repeatedly stated…

-

What Would Single Payer Look Like In California?

Posted From the Los Angeles Times By: Melanie Mason A proposal in California for a single-payer healthcare system would dramatically expand the state government’s presence in medical care and slash the role of insurance companies. New amendments released Thursday fill in some key details on the universal healthcare measure proposed by state Sens. Ricardo Lara (D-Bell Gardens) and Toni…

-

Join Us in New York, NY!

Single-Payer Strategy Conference Jan. 13 – Jan. 15, 2017 You are invited to join hundreds of activists for a weekend of inspiration and strategy to win single-payer national health insurance! Click here for more info.

-

Doctors Report On America’s Health

Two doctors and a nurse report on the state of America’s healthcare, the Affordable Care Act (Obamacare), and their future under a Trump Administration. First-hand reports from the recent Physicians for a National Health Program national conference in Washington DC. The Republican Healthcare Plan(s) Jeff Gee, family physician and chair of the Bay Area chapter…

-

Prop. 61 loses, Big Pharma wins

From L.A. Times California props Nov. 9, 2016, 12:50 p.m. Prescription drug pricing measure Proposition 61 goes down to defeat Christine Mai-Duc (Alicia Chang / Los Angeles Times) Proposition 61, the most expensive statewide initiative on the ballot this November, has been defeated by a 54-46 margin. The ballot measure sought to lower prescription drug prices by…